Utilising several of the new waves of disruptive technologies such as big-data analytics, artificial intelligence (AI) and cloud computing, neobanks across the world are fundamentally transforming the very notion of banking. And given the restrictive impact that the coronavirus pandemic is having on the global population, there is now a growing belief that this new digital model of banking will play a critical role in addressing the shortcomings posed by traditional lenders.

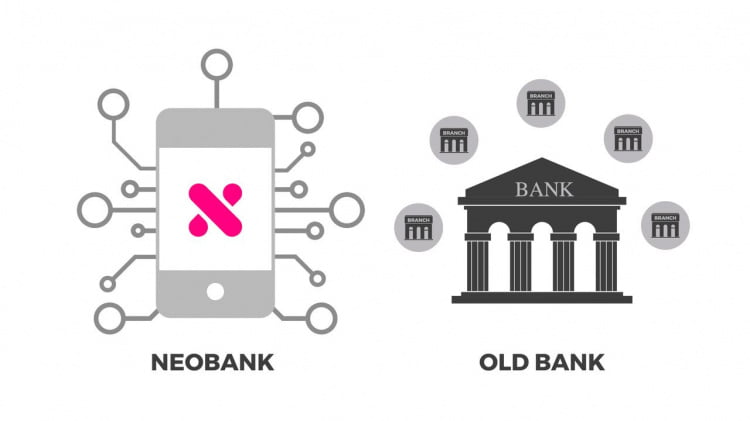

Simply put, a neobank is a type of bank that operates exclusively through digital channels. It has no physical branch network or legacy infrastructure, meaning that all neobank business is conducted through digital means, such as mobile apps and online platforms. As a term, it is often used interchangeably with challenger bank. And while they both rely heavily on the digital realm, there are some key differences to highlight. For one, neobanks are exclusively digital and tend to rely on a partner bank to obtain the appropriate licensing and regulatory approval, whereas challenger banks have their own full banking licenses. Challengers also typically offer a much broader suite of financial products and services and will tend to, but not always, have at least some physical brick-and-mortar presence, although the range of offerings that are available at neobanks is growing all the time.

With their business models focused entirely on the digital world, perhaps the biggest advantage neobanks hold over traditional financial institutions during these troubling times of virus-induced economic gloom is that there are no physical bank branches to monitor—or, indeed, to close down. Neobanks thus represent a tempting alternative to traditional banks by offering virtually the same range of products and services to customers without the need for them to visit a branch. This also benefits bank staff, who can work remotely rather than having to be physically present at a branch.

And thanks to cloud-based infrastructure, neobanks can quickly adapt to customers’ changing needs and wants; indeed, those changes may transpire quickly and abruptly given the ongoing uncertainty brought about by the pandemic. “Integration with APIs and micro-services is widely available as the ecosystem around the cloud grows, allowing neobanks to get their products to market at a tremendous speed,” Eelco-Jan Boonstra, managing director, EMEA, of software-as-a-service banking platform Mambu recently told fintech news source Finextra.

With COVID-19 set to usher in some permanent changes that will dramatically boost the need for comprehensive digital-banking capabilities, therefore, neobanks will play a hugely important role within the global banking industry during the next few years.